Introduction to Funeral Cover Finder

Funeral Cover Finder is free funeral insurance quoting service brought to you by InShoor (PTY) Ltd. We are a registered financial services provider: FSP# 43216

Firstly, we are not an insurance lead aggregator. We do not sell data or send your personal details to several companies. This is very good news. What this means is we manage the entire sign up process from start to finish. We do not want to annoy you with frequent sales calls. It’s important to know because this means you will speak to the same friendly agent from our company. Because you speak to just one agent, you can talk about any of the products on our website with the same person. This makes it easy and hassle free to get your free quote.

About Our Team

Secondly, our humble team of 25 staff members is just waiting to serve you. We are dedicated to make the process as quick and hassle free as possible. We know how important your time is and always do our best to offer you amazing service. All our staff members know the products they sell. They are dedicated and friendly. There is a reason we are an multiple award winning brokerage. It’s because we treat our customers like family.

Only the Best Funeral Cover Providers

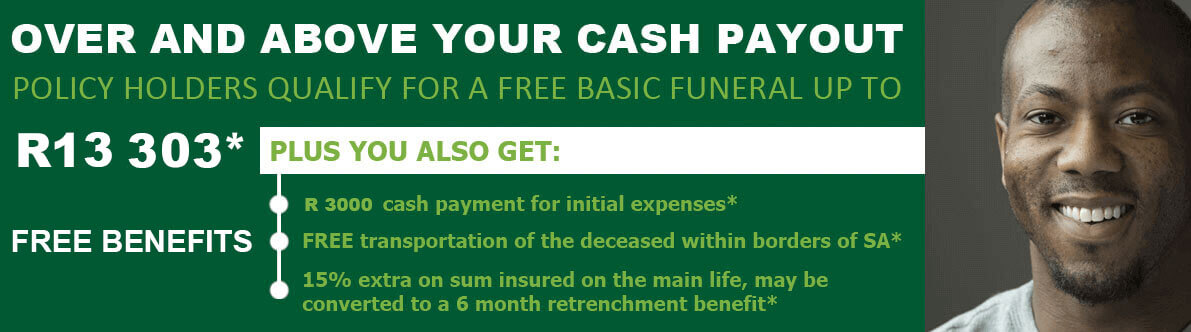

Lastly, we went to the ends of SA to find the best funeral plan providers. Our staff members did all the hard work so you do not have to. At the moment, we represent AVBOB, Metropolitan, Discovery. We always research our insurance providers to make sure we offer only the best out there. Our humble service offers our deserving clients FREE funeral cover quotes from top providers. That’s right; our hassle free service is free of charge. If you are 100% satisfied with your free funeral insurance quote, we will arrange your funeral policy at no additional costs to you.

World Class Service

Our company has been awarded top AVBOB broker nationally every year from 2012 to 2017. At the moment, we are the only independently owned AVBOB call center in South Africa. We strive to bring our clients nothing but the best possible service. This is the reason why we have thousands of satisfied customers across SA. Remember, our competent squad will arrange your policy without you ever having to leave your home. We have a national call center based in Centurion.

For more information about us, please visit our official website by clicking here.